Factors behind the success of US mid-market businesses

revealed by Moore study

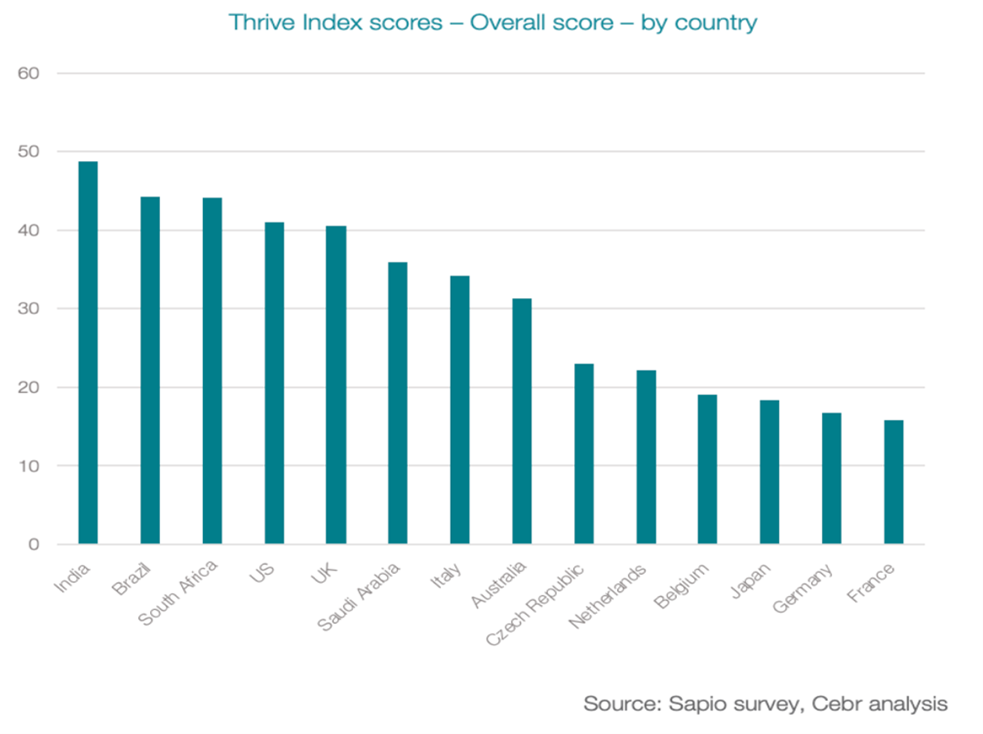

The Thrive Index collated the views of more than 2,000 businesses leaders across 14 key economies on five “performance pillars”. Those are: general sentiment about the business environment; revenue; costs; the labor market and investment.

US mid-market businesses have performed more strongly than rivals in other key economies and are more optimistic about the future, according to Moore’s new Thrive Index.

The US score for the first Moore Thrive Index is +41, indicating general positivity among the leaders of mid-market businesses. This compares favorably with the survey average for the world as a whole, which was +35.1.

In fact, the US placed fourth overall on the Thrive Index, only surpassed by fast-developing India, Brazil and South Africa. It recorded higher scores than the average across all but one of our five performance pillars.

The US scores were particularly strong on labor, revenue and business performance over the past year, although the gap in sentiment between the US and rest of the world narrows when looking forward to the next 12 months.

The cost pillar was the only one for which the US recorded worse scores than the average across our global study. This aligns with the economy’s experience of higher-than-normal inflation in recent years.

|

+41

|

+35.1

|

84%

|

|

Thrive Index score

for US businesses

|

Thrive Index score

for whole world

|

US firms positive about

benefits of automation

|

The US is a global technology powerhouse and its business population is embracing the benefits. A larger share of US businesses reported changing their investment in technology and digital tools over the past year – and the pattern is likely to continue over the coming 12 months.

Some 84% of US respondents said that automation had been positive for their business, outstripping the equivalent figure for the sample as a whole (77.4%).

The Thrive Index also reveals the US diverging from the rest of the world on the complex issue of supply chain disruption. Around one-in-six US companies were experiencing disruptions without finding opportunities as a result of changes in tariffs and global trading patterns. That compared to only 10% of the whole sample.

On the energy transition and net zero agenda, US businesses were more likely to be making investments in these areas and identifying them as core aspects of business strategy. This was the case for 44% of US respondents, compared to 33% of all respondents.

The US is part of a global Moore Thrive Index project, which produced the following results:

-

Business performance has been strong, with roughly three out of four of companies reporting improved results over the past year. Digital transformation was the primary driver, while subdued demand remains a significant concern.

-

Revenue growth has been broad-based, with just over two-thirds of businesses recording higher revenues. The strongest gains were reported by the most productive firms.

-

On costs, 43% of firms identified labor as the main expense pressure, reflecting ongoing tightness in the employment market.

-

In terms of labor force dynamics, half of businesses increased headcount over the past year. However, we also detect a significant change in attitudes to remote working with 65% of business leaders anticipating a shift back to the office.

-

Investment activity is picking up as inflation moderates, with almost half of those surveyed prioritizing technology and digital tools.

Moore Thrive Index

CLICK HERE to view the complete Moore Thrive Index